Buffett’s annual letter – No Pause At Yellow

Submitted by Trott Brook Financial on March 9th, 2018The 2017 Berkshire Hathaway annual report is out. It is always highly anticipated as it contains Warren Buffett’s annual letter to shareholders which usually is packed with nuggets of investing wisdom. The 2017 chairman’s letter touched on a host of topics this year including the impact of the new tax law on Berkshire Hathaway, the lack of attractive investment opportunities, Berkshire’s operating highlights, and several valuable lessons for individual investors.

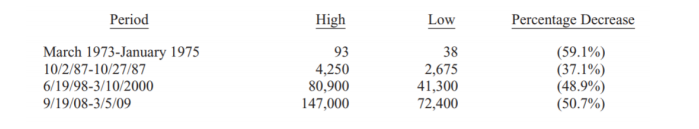

For individual investors, Buffett emphasized the importance of keeping things simple, managing costs and not borrowing money to invest in stocks. He reminded investors that markets can do extremely crazy things over short-periods which is why using borrowed money to invest is particularly risky. To accentuate this last point, Buffett highlighted four different times when Berkshire’s stock price cratered very rapidly. With the jolt of market volatility experienced at the beginning of February, this point particularly resonated with me.

Before I share the figures, I should point out that Buffett purchased his first shares of Berkshire Hathaway in 1965 for $7.50. At the time, the corporation was nothing more than a gradually declining New England textile company. One of the great ironies of the Berkshire story is the original textile business ultimately failed. But Buffett used the corporate shell to create what is now one of the largest conglomerates in the world. As of February 27, 2018, those original shares Buffett bought for $7.50 had a market value in excess of $316,000. To put that into perspective, a $10,000 investment alongside Buffett in 1965 would now be worth over $421 million.

Those numbers are absolutely eye-opening. But the greater point I want to emphasize is the tremendous compounding that occurred at Berkshire included a number of huge temporary declines. As Buffett put it on CNBC, there have been four distinct occasions when the price of Berkshire Hathaway fell anywhere from roughly 40-60% in a matter of months. From page 10 of the annual report:

’ll speculate that Buffett touched on this because he’s witnessing the same thing I’ve seen in recent months, increased risk taking amongst investors.

It’s amazing the power of rapidly rising prices to suck people in and alter their perception of risk. In cycle after cycle, we see the same investors who have been sitting on the sidelines for years out of fear, finally capitulate after a swift rise in prices. Unfortunately, just when many of these investors finally feel confident enough to put their money to work, it turns out to be the worst possible time.

My biggest concern is investor confidence is up sharply (in tandem with asset prices). With that generally comes a perception that there is less risk in the market-place. The problem is, that perception is an illusion. There have been countless times in market history that just when it seemed as if nothing could go wrong, something did.

My point here is not to sound the warning bell that a severe market downturn is imminent. Rather, it’s just a reminder that in investing, anything can happen at any time. Buffett put it this way in the chairman’s letter:

“No one can tell you when these [market disruptions] will happen. The light can at any time go from green to red without pausing at yellow.”

As we enjoy the ongoing economic expansion and favorable market conditions, don’t forget that there will be unpleasant surprises. This type of environment (when times are good) is when it’s most important to understand what type of risk you have exposure to. Thinking you can wait until the markets turn is a big mistake because, as Buffett said, there often is no pause at yellow.

You can find Warren Buffett’s annual letter in its entirety at the following link:

http://www.berkshirehathaway.com/letters/2017ltr.pdf

Disclosure

Advisory services offered through Trott Brook Financial, LLC, a registered investment advisor. Securities offered through LaSalle Street Securities, LLC, a FINRA/SIPC member broker/dealer. Trott Brook Financial, LLC and LaSalle Street Securities, LLC are unaffiliated separate legal entities.